Older Americans Losing Billions to Scammers

Safeguarding Older Americans and their Caregivers from financial ruin

My mother got scammed. After a long phone call with “a very nice lady” she handed over banking information. To her credit, she reflected on what happened and called me. So why did this happen to a woman that I have trained to be alert to strangers who call her? I called the phone number of this scammer. You see, my brother was clever, he set me a screen shot of the call log for that day. I placed a call to this ‘company’ and engaged as a vulnerable person to experience what my mother had described to me.

Take a step back and think about the words and phrases we use in caregiving and aging. We talk about protection, trust, familiarity, compassion, and empathy. When a scammer exhibits these qualities, they gain access to a vulnerable person’s personal information. When the ‘peace of mind’ tactic wears thin then clever thieves amp up the heat with scary consequences. In fact, threatening a vulnerable person’s safety is very effective like in this short video.

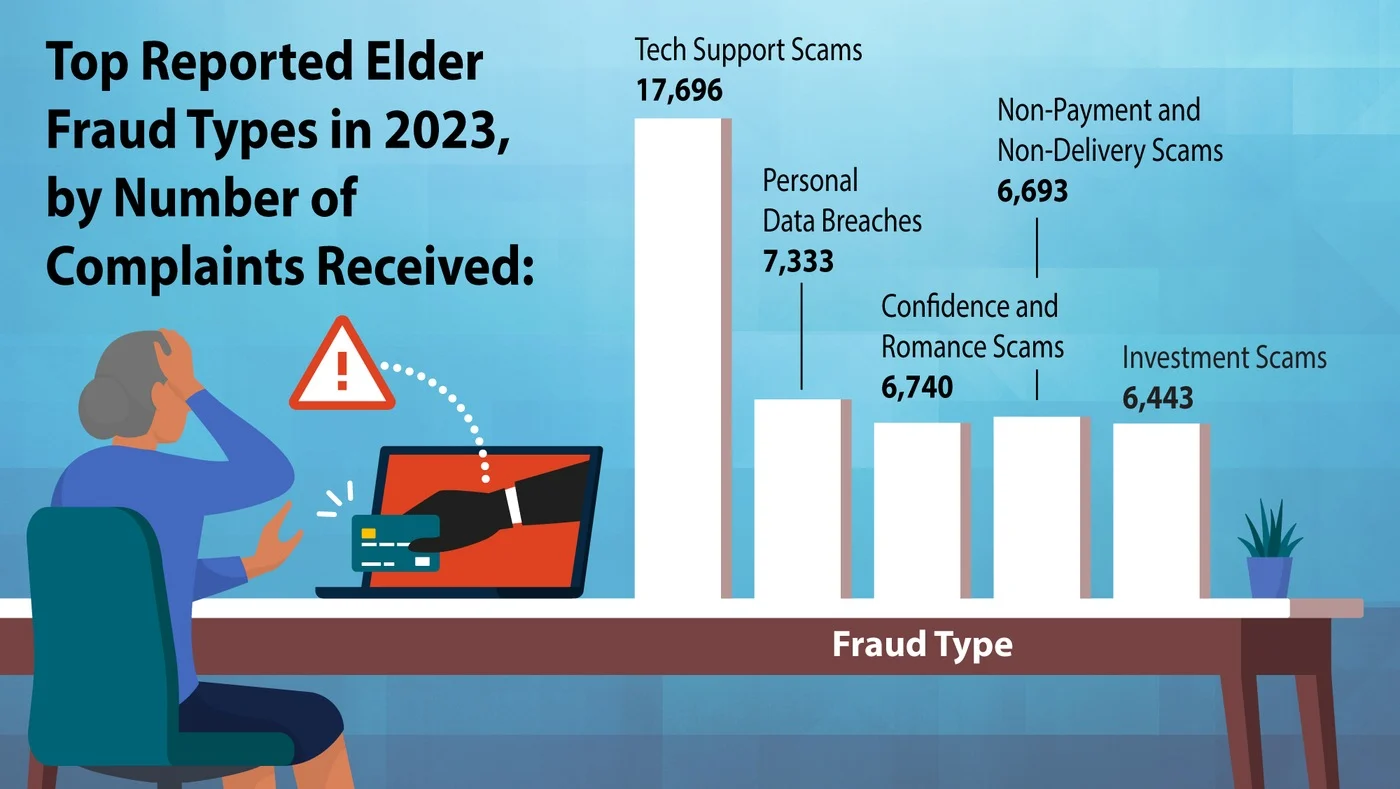

According to the FBI in 2023, fraudsters stole $3.4 billion unsuspecting or terrified elderly Americans. On average, the victims lost $33,915.00 of savings and income. This is a growing industry increasing eleven percent over reported crimes in 2022. Moreover, these statistics represent reported crimes, so the loss is most likely much higher.

In today’s digital age, where smartphones and the internet dominate daily life, financial scams have become a prevalent threat, especially for the elderly. Older adults, often seen as easy targets due to their trusting nature and potential lack of technological savvy, are increasingly falling victim to phone scams. In fact, these scams can result in significant financial losses, emotional distress, and a sense of betrayal.

The Rise of Financial Scams Targeting the Elderly

Phone scams targeting the elderly have risen sharply in recent years. According to the Federal Trade Commission (FTC), older adults report losing hundreds of millions of dollars annually to various phone scams. These scams range from fake IRS calls and lottery scams to tech support frauds and the notorious “grandparent scam.” Lastly, the methods used by scammers are becoming increasingly sophisticated, making it challenging for even the most cautious individuals to discern the fraud.

Federal Trade Commission Annual Report

The Federal Trade Commission (FTC) released the 2023 annual national report on fraud. This tells a broader story about how and how these crimes were committed. The biggest losers happened as bank transfers, like what was attempted on my mother. Americans lost one billion eighty-six million dollars by handing over banking information to thieves.

Cryptocurrency bilked people out of nearly one and a half billion dollars. Emails are the most common forms of solicitations followed by phone calls, text messages and social media platforms. Credit care fraud is rampant as well as other forms of identity theft. Active duty and retired military are targeted with an average loss of six hundred dollars higher than the general public. Here is a link to the entire FTC report.

Psychological and Emotional Impact

Beyond the financial repercussions, phone scams can have severe psychological and emotional impacts on elderly victims. The realization of being scammed can lead to feelings of shame, guilt, and decreased self-esteem. Keep in mind, many victims may not report the scam due to embarrassment or fear of losing their independence. This emotional toll can lead to increased anxiety, depression, and social withdrawal, exacerbating the overall harm caused by the scam.

Why Are the Elderly Targeted?

Several factors make the elderly more susceptible to phone scams:

- Trusting Nature: Many older adults grew up in a time when trust and courtesy were commonplace, making them more likely to believe and respond to phone calls.

- Lack of Technological Proficiency: Not all elderly individuals are comfortable with modern technology, making it easier for scammers to deceive them.

- Social Isolation: Loneliness can make the elderly more willing to engage in conversation with strangers, increasing their risk of being scammed.

- Cognitive Decline: Age-related cognitive decline can impair judgment and make it harder for elderly individuals to recognize scams.

Stop Scammers

Phone scams targeting the elderly are a significant and growing problem that requires collective effort to combat. By raising awareness, educating our elderly loved ones, and implementing protective measures, we can help reduce their vulnerability to these malicious schemes. It’s crucial to foster an environment where the elderly feel safe and supported, knowing they can turn to family and community for help without fear or embarrassment. Together, we can make a stand against financial exploitation and protect those who have spent their lives caring for us.