Scammers Target Vulnerable People Read How to Fight Back

The Beekeeper

Older Americans Losing Billions to Scammers Part Two

Did you watch the movie The Beekeeper? The very talented Jason Statham is a retired special operations specialist turned beekeeper living a quiet life in rural Virginia. Yes, it is an action film filled with martial arts fight scenes and high-tech explosions. Set that aside and focus on his motivations for tracking down these criminals who are stealing the life savings of senior adults. Like him, I believe there is a special place in hell for those who prey on vulnerable people.

$10 Billion Lost to Fraud in 2023

I watched the Beekeeper after I penned the first article about scams and hacking. The social media replies to that piece broke my heart and keep this issue top of mind for me. These criminals exploit people’s fears and lack of technical knowledge. According to the FTC, consumers reported losing more than $10 BILLION to fraud last year, a 14% increase compared to 2022. Pew Research surveyed Americans about scams and issued a report on their findings. Did you know that forty-one percent of those surveyed said they found fraudulent charges on their credit cards? You thought you were the only one. And it is not just credit cards, Pew Research reports that their email accounts, social media (Facebook profile with all those photos of you and your family), loan applications, Social Security numbers, and other vital forms of identification are getting breached. Needless to say, I believe the Beekeeper is a superhero.

Scammers Prey on Vulnerable People

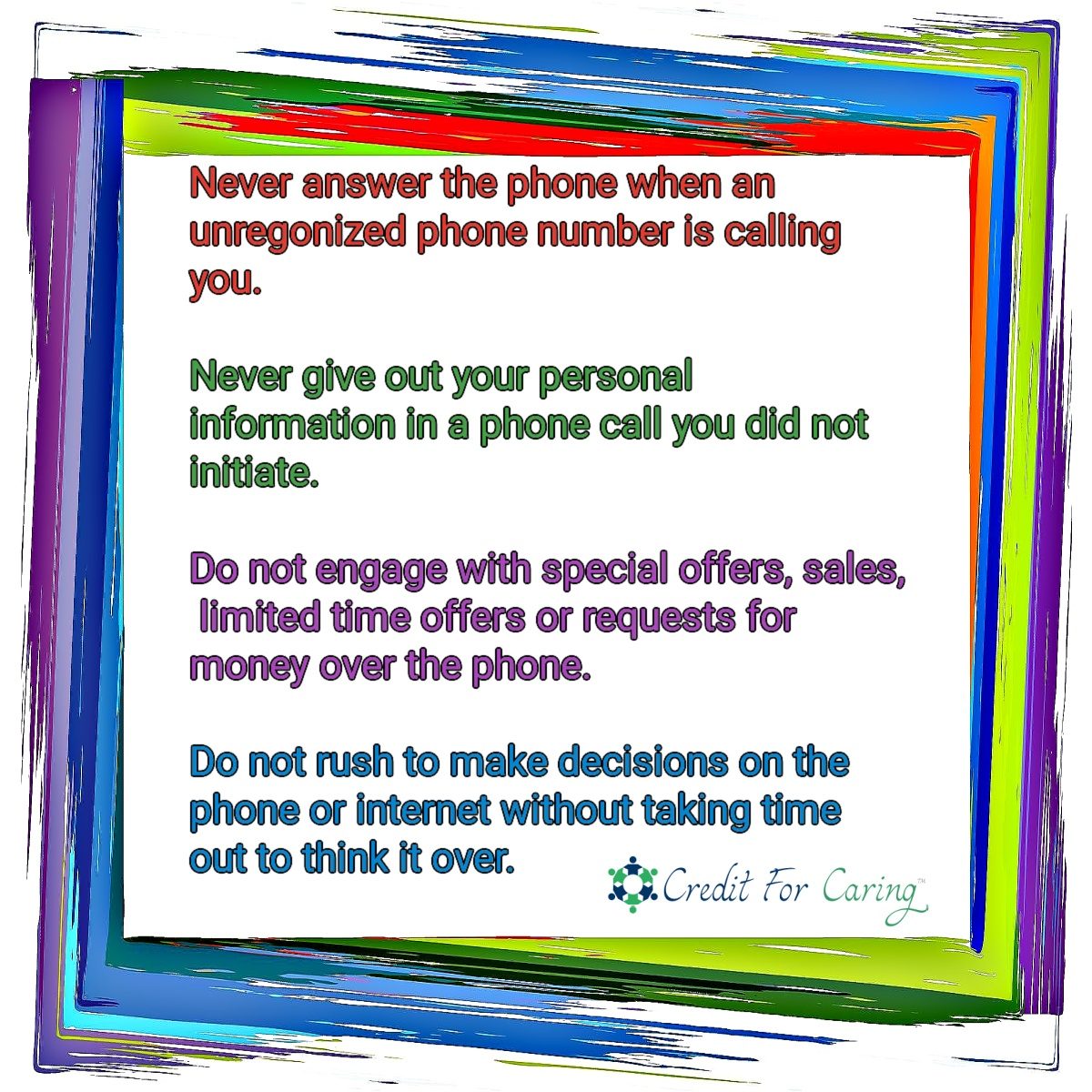

Scammers often target older adults because they may be more trusting or less familiar with the latest scams. Here are the most common scams right now. Keep in mind these can and will change.

- Phishing scams: These involve emails or phone calls that appear to be from legitimate sources, such as banks or government agencies, requesting personal information.

- Grandparent scams: Scammers pose as a grandchild in need of urgent financial assistance.

- Romance scams: Scammers build trust with their victims through online dating or social media before asking for money.

- Sweepstakes scams: Victims are notified that they have won a prize but must pay a fee to claim it.

- Crypto Get Rich Quick Scams.

In 2023, a lot of people were scammed using cryptocurrency, like bitcoin and ether. The FBI got over 69,000 reports about this, with losses adding up to more than $5.6 billion. Even though only 10% of all fraud complaints involved cryptocurrency, these scams caused almost half of the total money lost. Most scams were investment scams, where people were tricked into sending cryptocurrency, making up 71% of all losses.

Other scams, like fake tech support or pretending to be the government, also used cryptocurrency, causing about 10% of losses. Cryptocurrency is popular with criminals because it’s fast, hard to trace, and the money can be moved anywhere in the world. Once you send it, it’s very difficult to get it back.

Federal Bureau of Investigations Crime Complaint Center

The FBI’s Internet Crime Complaint Center (IC3) collects reports from people who have been scammed. The FBI works with other law enforcement and financial groups to investigate these scams and try to stop the criminals. They want to warn people about these scams and help protect them from losing money in the future.

Scams and Recovery: A Guide for Vulnerable People

Scams can be particularly devastating for older adults, who may be more vulnerable due to factors like decreased mobility, reliance on others, or changes in cognitive function. If you or someone you know has fallen victim to a scam, it is important to know that there are steps you can take to recover and prevent future incidents.

What to Do If You’ve Been Scammed

If you believe you’ve been the victim of a scam, take the following steps:

- Don’t Panic: It is important to stay calm and avoid making any rash decisions. Do not return the phone calls or click on computer links that started the problem. Stop thinking those friendly voices are real. Scammers are manipulating you!

- Document the Scam: Write down everything you can remember about these conversations. Gather as much information as possible about the scam, including any emails, phone calls, or correspondence. Keep in mind these people are not who they say they are. Suzy Sunshine does not care about you despite how good the conversation made you feel.

- Freeze Your Accounts: Call your bank immediately. File an incident report for potential fraud. If you believe your personal information has been compromised, freeze your credit cards and bank accounts to prevent further damage.

- Monitor Your Accounts: Keep a close eye on your bank and credit card statements for any unauthorized activity. Now is the time to be highly engaged with your finances. Look for unusual activity. In fact, sometimes the charge may be for one penny or one dollar. This is likely the criminals ‘test driving’ your account.

- Place a Fraud Alert: Contact the three major credit bureaus (Experian, Equifax, and TransUnion) to place a fraud alert on your credit report. This will make it more difficult for scammers to open new accounts in your name.

- Update Your Passwords: Change your passwords for all of your online accounts, including your bank, email, and social media.

- Be Wary of Future Scams: Stay informed about the latest scams and be cautious about sharing personal information with anyone you do not know well.

- Contact the Authorities: Report the scam to your local law enforcement agency and the Federal Trade Commission (FTC).

Talk it Out

Seek support if you are feeling overwhelmed or stressed after being scammed. Consider talking to a therapist or counselor, joining a support group, or reaching out to a trusted friend or family member (or watch the Beekeeper movie). You are not alone. Many people fall victim to scams, and there are resources available to help you recover and prevent future incidents.

My Trusted Experts

The Beekeeper is a fictional story. However, we raised two sons who are educating us, their parents, on the ways of this world. They insisted we use two new technologies to harden our defenses against scams and breaches.

The first recommendation is to install a password management app that works across all our devices. Fortunately, I have used OnePassword since 2016 at Jim Slusser’s insistence (thanks my friend). I do not ‘know’ my passwords, and no one can guess them since they are randomly generated characters stored in the app and not written down (criminals love finding your address book with all those passwords and identification information). Thanks to this app, I remember only one password or use facial or fingerprint recognition to open my online world.

Secondly, we have wiped our breadcrumbs of data off the web using the Delete Me app. I feel better knowing that criminals and unscrupulous marketers will find it more difficult to collect and sell my information. Think of this as your bank vault of personal data, you hold the key. If my sons offer any new pearls of wisdom I will certainly share them with you. Until then, Hazard Yet Forward.

Share This Story, Choose Your Platform!

About the author : Monica Stynchula

Credit for Caring: Your Modern DIY Aging in Place Feeling overwhelmed? We've got you! Expert tips, safety products, & innovative solutions for solo agers, families, and communities. Personalized plans, must-have resources, & a supportive community await. Save big & simplify caregiving: Creditforcaring.com