2024 Unfinished Business Pass $5,000 Tax Credit for Family Caregivers

2024 Unfinished Business Pass

$5,000 Tax Credit for Family Caregivers

In the tapestry of American life, family caregivers form a vital thread, often unseen and undervalued. These individuals dedicate their time, resources, and emotional energy to caring for loved ones who may be aging, disabled, or facing chronic illnesses. Despite their critical role, family caregivers receive little financial support or recognition. The Credit for Caring Act, a bipartisan initiative, seeks to address this disparity by providing a non-refundable tax credit of up to $5,000 for eligible family caregivers. This legislation isn’t just a gesture of gratitude—it’s an economic and social imperative. Here’s why the federal government should prioritize passing this Act in the closing days of business of the 118th Congress.

The Scope of Family Caregiving in America

Family caregivers represent a silent workforce of millions of Americans. They provide unpaid care to individuals of all ages—whether a terminally ill child, an aging parent, or a spouse with a disability. According to AARP, family caregivers collectively contribute an estimated $600 billion annually in unpaid labor. Their efforts reduce the strain on healthcare systems and delay or prevent costly institutional care, saving taxpayer dollars.

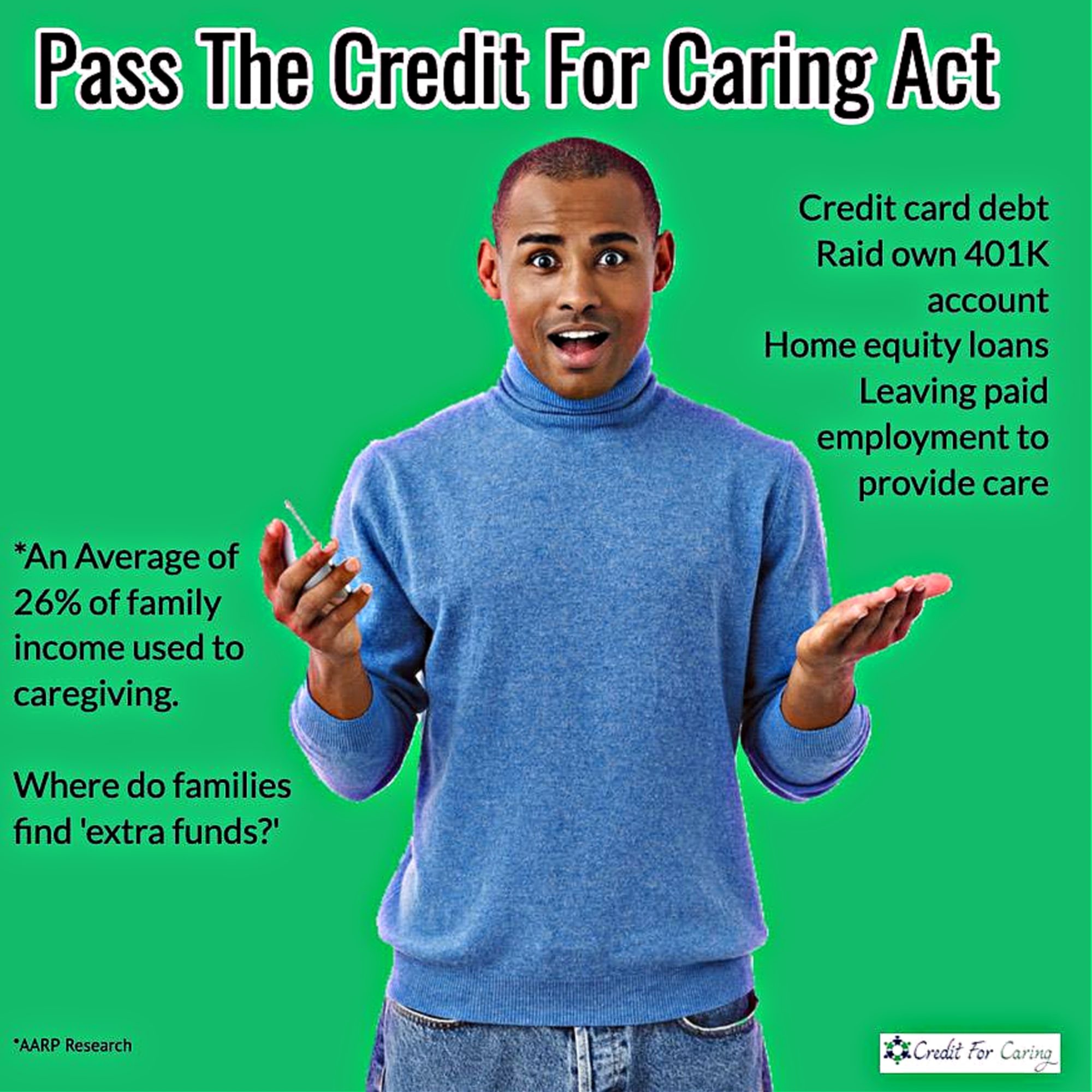

However, caregiving comes at a steep cost for families. On average, caregivers spend over $7,200 annually out of their own pockets to meet the needs of their loved ones. Beyond financial strain, caregiving often results in lost income, reduced retirement savings, and diminished job opportunities. These sacrifices, compounded by physical and emotional stress, demand that the federal government step up with meaningful support. A recent segment on CBS morning show explains the impact on our country.

The Economic Rationale for a Caregiver Tax Credit

The economic case for the Credit for Caring Act is clear. By providing a $5,000 tax credit to unpaid family and friend caregivers it would slightly reduce the financial burden of paying for personal care, home safety, transportation, and non-reimbursable care costs. Additionally, it would enable working caregivers the option to use respite care or professional care services to fill in care gaps. In fact, the tax credit is an important tool for employees.

Lastly, to those legislators still undecided about the broader economic impact, we have a broken care system. We pay for expensive hospital care, yet we fail to support the daily care providers that can reduce the need for high-cost interventions. Family caregivers play a crucial role in keeping loved ones out of expensive nursing homes and reducing hospital readmissions. Supporting caregivers is a cost-effective way to strengthen community-based care and lower Medicaid and Medicare expenditures.

Lessons from the Child Tax Credit

The success of the Child Tax Credit offers a compelling parallel to the caregiver tax credit. In 2021, this initiative lifted 5.2 million children above the poverty line, reducing child poverty by 5.2% according to the U.S. Census Bureau. The program demonstrated that targeted tax relief can alleviate financial hardship and improve quality of life. Similarly, the caregiver tax credit could help millions of families avoid financial ruin while ensuring their loved ones receive the care they need. It’s a modest investment with transformative potential, addressing both economic inequities and the caregiving crisis.

The Emotional and Physical Toll of Caregiving

Caregiving is not just a financial commitment—it’s an emotional and physical challenge that takes a significant toll on families from stress and burn-out, neglecting their own care needs, and the harmful impact of social isolation. A $5,000 tax credit may not eliminate these challenges, but it would provide a tangible acknowledgment of the caregiver’s contributions and alleviate some of their financial stress. This support could also enable caregivers to access resources, such as respite care or mental health services, that improve their well-being.

Generational Impact of Caregiving

The caregiving crisis isn’t limited to one generation—it affects families across the lifespan. Millennials now account for 25% of family caregivers, often juggling caregiving responsibilities with student loan debt, careers, and young children. Meanwhile, Baby Boomers and Gen X caregivers are depleting their retirement savings to care for aging parents. Without intervention, the ripple effects of caregiving will extend to future generations. Families who spend their savings on caregiving may become reliant on their children for financial support in retirement, perpetuating a cycle of economic hardship. The Credit for Caring Act addresses this issue by providing immediate financial relief to caregivers, helping them preserve their financial stability.

Show the Nation that Government Works

One of the most compelling aspects of the Credit for Caring Act is its bipartisan and bi-cameral support. Introduced by Senators Ernst, Warren, Bennet, and Capito, and championed in the House by Representative Linda Sánchez, the Act bridges ideological divides to prioritize the needs of caregivers. With 74 sponsors in the House and 22 in the Senate, the legislation reflects a shared recognition of caregiving as a universal issue that transcends political affiliation. This broad support underscores the importance of acting now. As Congress wraps up its session, passing the Credit for Caring Act would demonstrate a commitment to addressing the real challenges facing American families.

Breaking the Cycle of Caregiver Poverty

Caregiving often pushes families into financial insecurity. Many caregivers are forced to cut back on work hours or quit their jobs entirely, resulting in lost wages, reduced retirement savings, and fewer Social Security benefits. Over time, this financial instability compounds, leaving caregivers vulnerable in their own retirement years. By offsetting caregiving expenses, the Credit for Caring Act would help break this cycle. It’s a proactive measure that acknowledges the economic value of caregiving and ensures that those who dedicate their lives to helping others are not left behind.

The Cost of Inaction

Failing to support caregivers has far-reaching consequences. Without adequate financial support, many families will be unable to sustain caregiving, leading to increased reliance on institutional care. This shift would place greater strain on Medicaid, the primary payer for long-term care in the United States. Additionally, the physical and emotional toll of caregiving without support could lead to higher healthcare costs for caregivers themselves. The Credit for Caring Act offers a cost-effective solution. By investing in caregivers, the federal government can reduce long-term healthcare costs and support families in providing care at home—a preference expressed by most Americans.

America First Policy

At its core, the Credit for Caring Act is about values. It’s a recognition that caregiving is an act of love and service that deserves support. By passing this legislation, the federal government would send a powerful message: that family caregivers’ matter, and their sacrifices will not be overlooked. Caregiving is a universal experience that touches every family. Whether it’s a parent caring for a child with special needs, an adult child supporting an aging parent, or a spouse navigating the challenges of chronic illness, caregiving is a testament to the strength and resilience of families. The Credit for Caring Act honors that resilience and ensures that caregivers have the resources they need to thrive.

Pass the Act Before Time Runs Out

The Credit for Caring Act is more than a tax credit—it’s a lifeline for millions of American families. It addresses the financial, emotional, and social challenges of caregiving while recognizing the vital role caregivers play in our society. With bipartisan support and a clear economic rationale, the time to act is now. As the 118th Congress concludes its session, lawmakers have a choice: to prioritize the needs of caregivers or to let this opportunity slip away. Passing the Credit for Caring Act isn’t just good policy—it’s a moral imperative. It’s time to show America’s caregivers that their sacrifices are valued and that their government stands with them.

Let’s ensure that family caregivers have the support they need to continue their essential work—because when we invest in caregivers, we invest in the future of our nation.

Share This Story, Choose Your Platform!

About the author : Monica Stynchula

Credit for Caring: Your Modern DIY Aging in Place Feeling overwhelmed? We've got you! Expert tips, safety products, & innovative solutions for solo agers, families, and communities. Personalized plans, must-have resources, & a supportive community await. Save big & simplify caregiving: Creditforcaring.com